Consumer Sentiment on Financial Planning

Financial planning at any stage in life is met with certain consumer needs, concerns and questions. At Bradford Financial Center, we take a personal approach to financial advising and truly listen to our clients. That's why we conducted a survey of our clients and consumers about their opinions on financial planning.

Nearly 70% of survey respondents are retired with the remaining 30% being full-time employees.

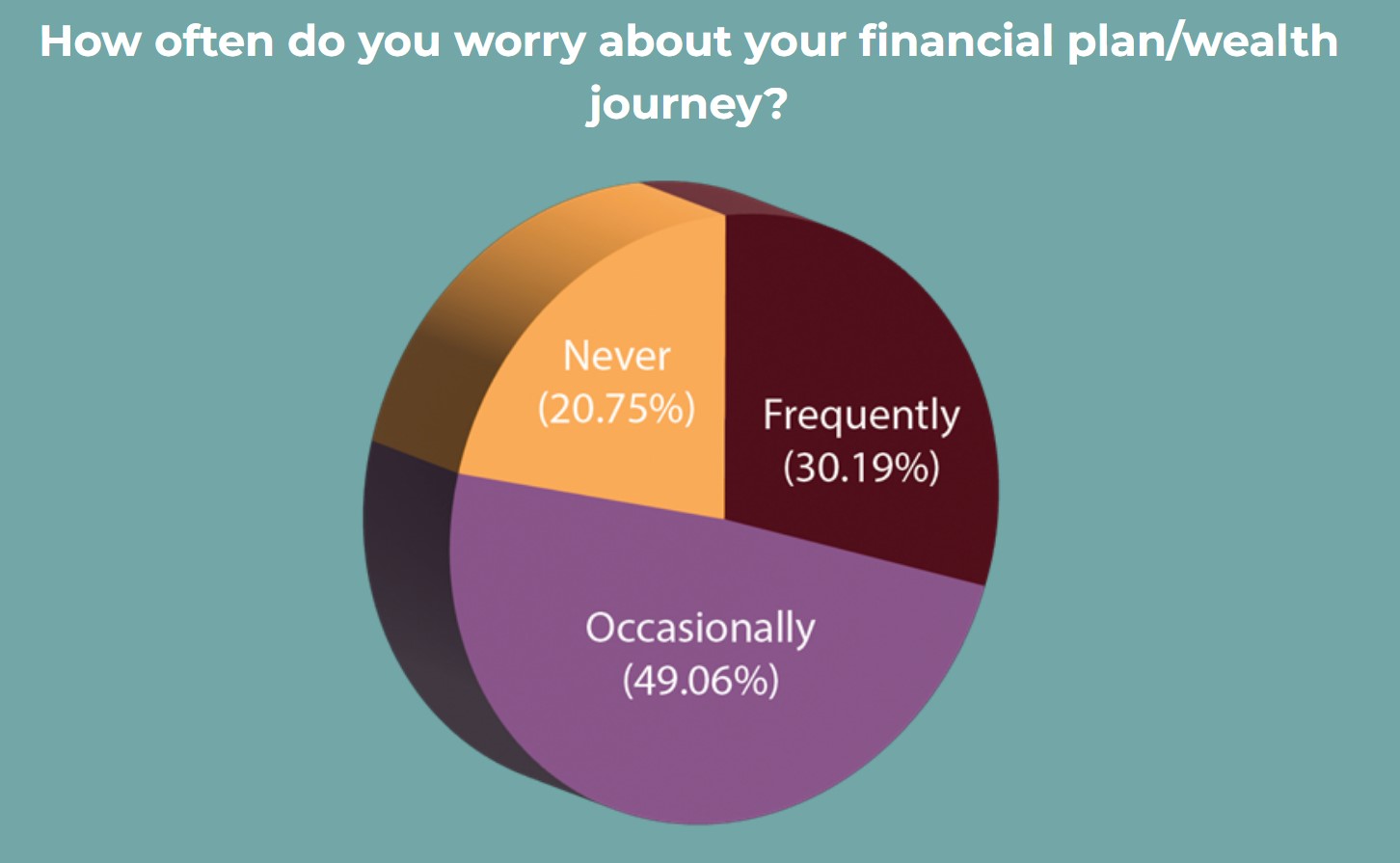

How Often Do You Worry About Your Financial Plan?

Financial anxiety is real. For many Americans, the looming concern about the state of their financial plan can cause more concern when it's not addressed. Respondents of our survey said they frequently worry (30%) about their financial plan suggesting that equates to about 12 times a year. Nearly 50% said they occasionally worry about it meaning a few times a year but more than just in the tax season.

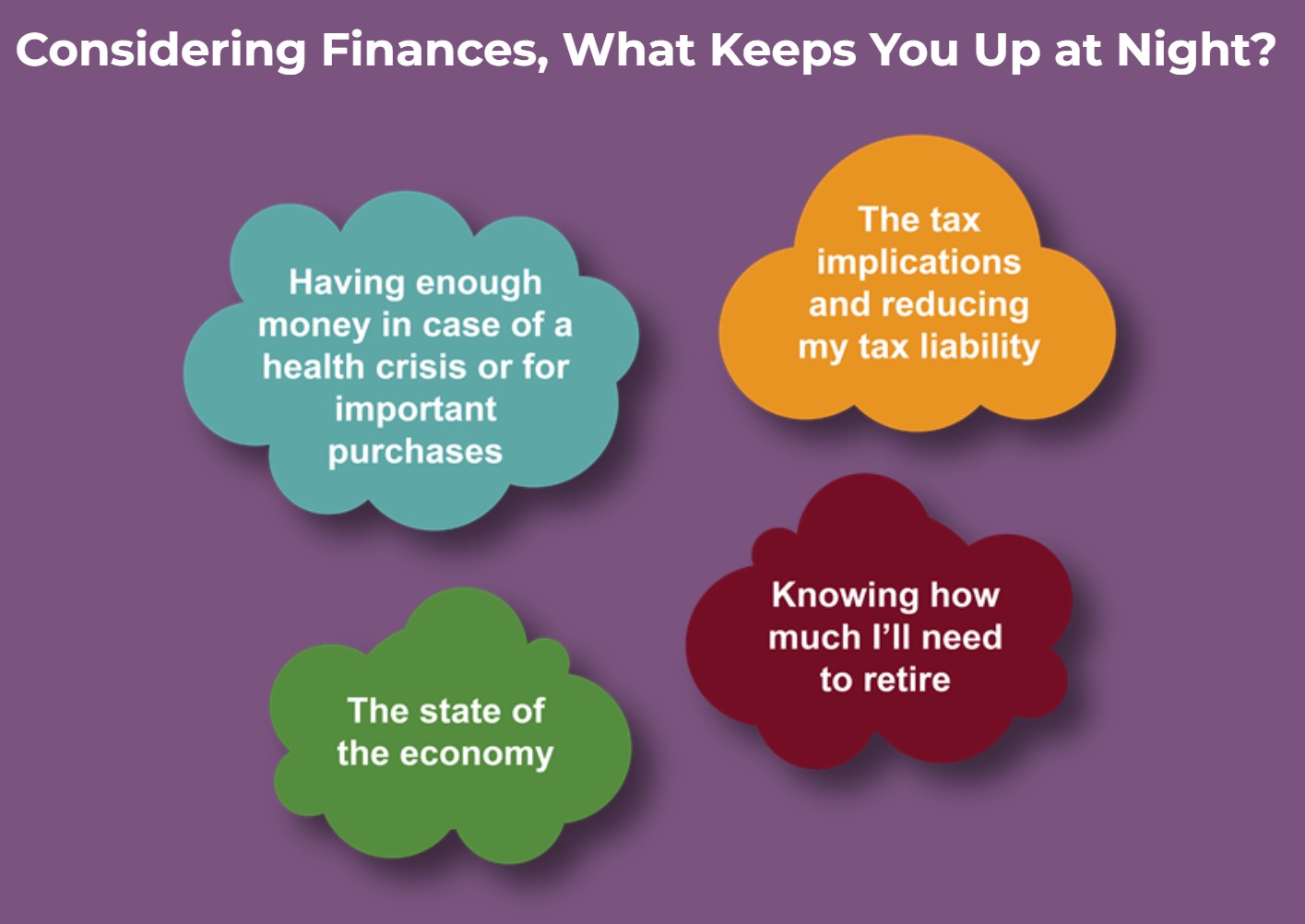

Personal Finances & What Keeps You Up at Night

When it comes to the biggest concerns around personal finances, the majority of respondents (32%) cited the tax implications of investing and reducing the tax liability as the greatest concern while others (12%)worry about that unique equation of calculating how much you need to retire and last through retirement. Economic and political situations or potential unrest weigh heavy on 6% of respondents.

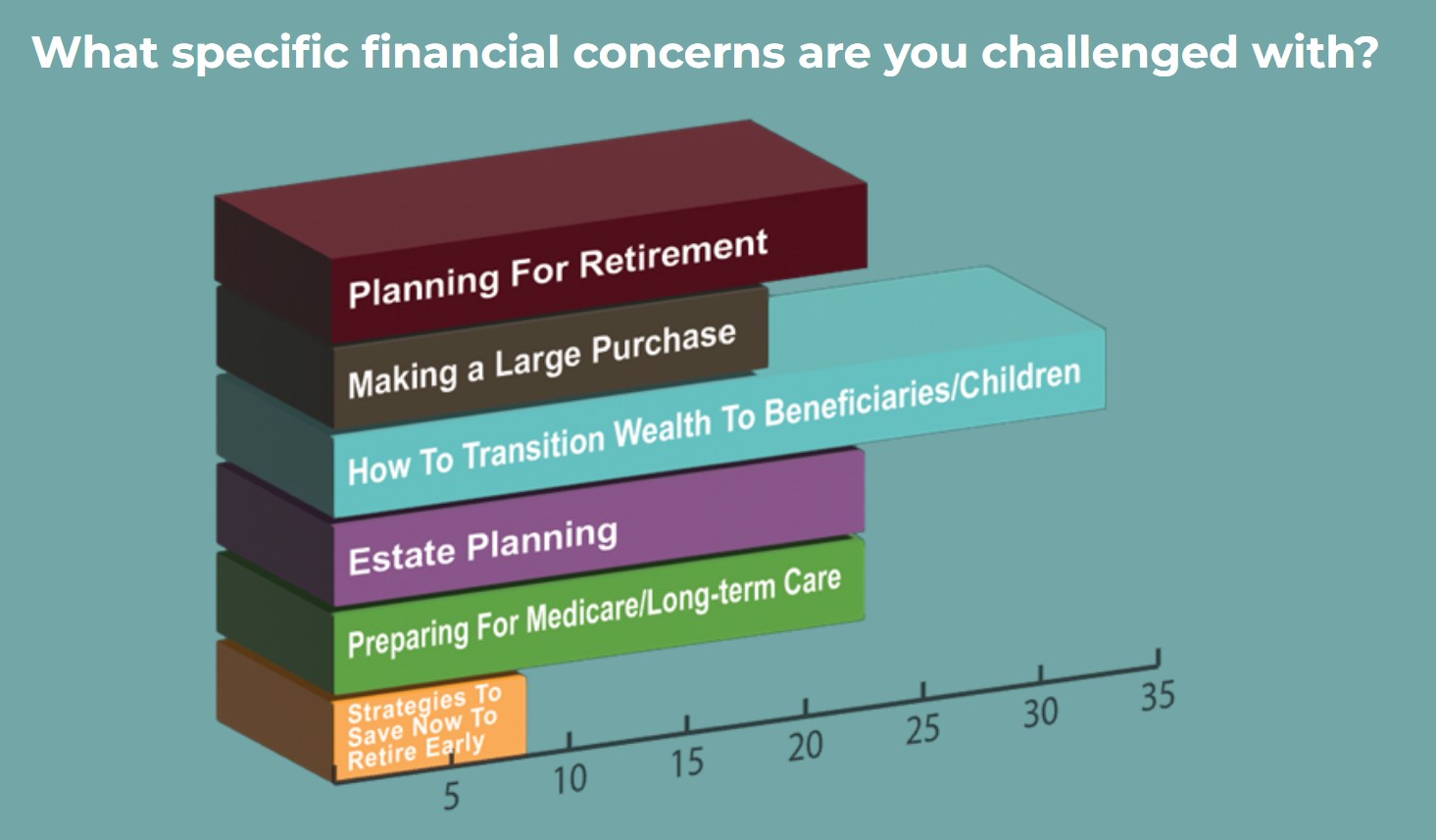

What Are Your Specific Financial Concerns?

Anything that ranks as your top financial concern is an important topic to discuss with your financial planner. These are areas that can be addressed with a smart, strategic plan. Here's how our respondents weighed in about the specific financial concerns that challenge them.

Biggest Concerns About Working with a Financial Planner

Hesitating to work with a financial planner or financial advisor? Respondents shared candidly their biggest concerns about working with a financial planner. With the rise of robo-investing, nearly half of those surveyed said they were concerned about the lack of one-on-one attention. Others want a financial advisor they can trust.

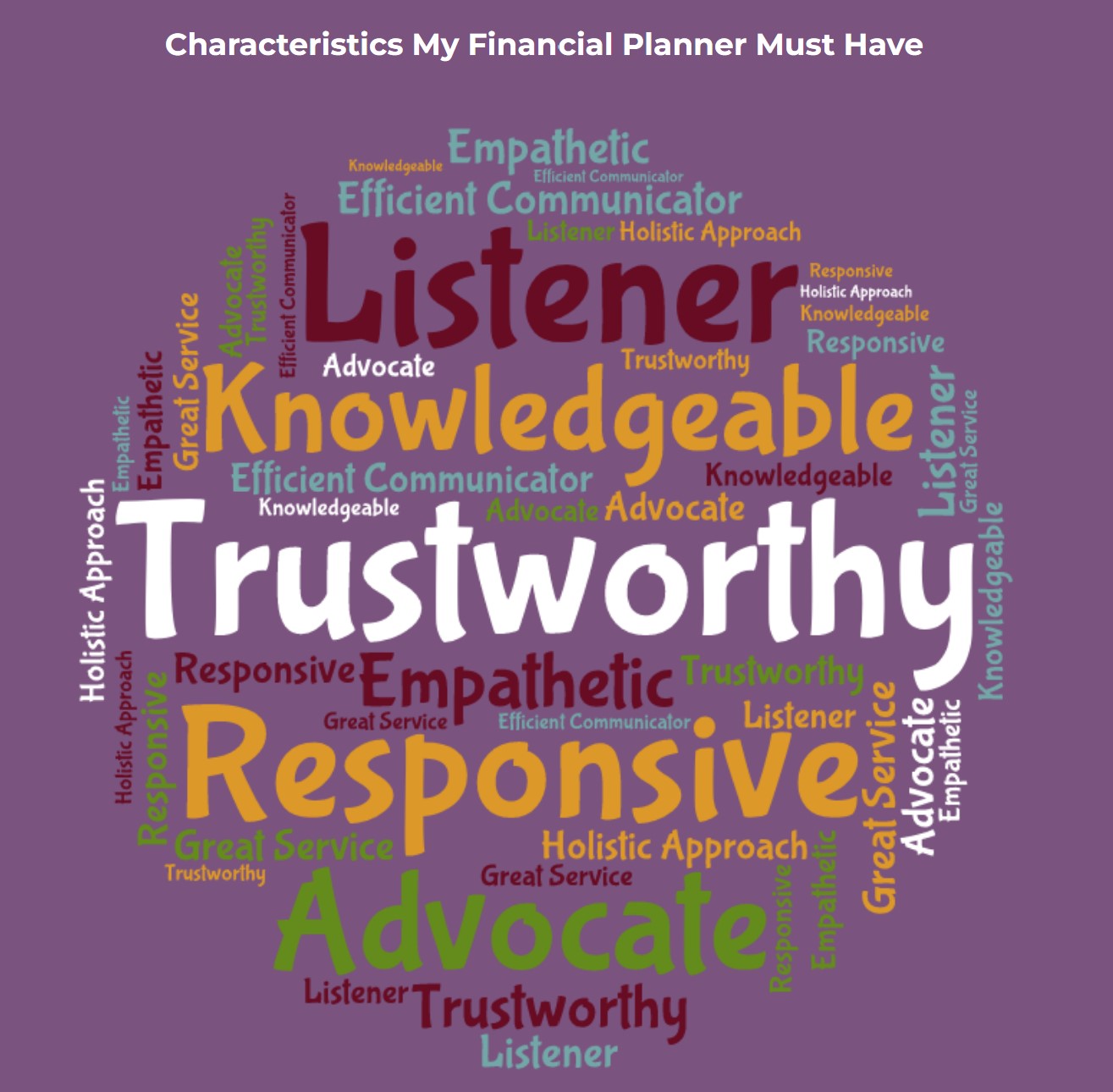

Characteristics My Financial Planner Must Have

Once again trust ranks high on the consumers' personal financial planning needs list for 87% of our survey respondents. A close tie for 56% of respondents was prompt, responsive communications and expertise or strong knowledge of financial products.

It's Time to Address Your Financial Planning Concerns Head On

Ready to start thinking about finding the right financial planner for your wealth journey? Developing a relationship and a personal connection with clients is paramount to fully understanding needs, current situations, risks, and other looming concerns.

When looking for a financial planner, ask for recommendations from family and friends and inquire about how they communicate with clients and how frequently. Ask the financial planner how many years of experience they have and whether they recommend financial strategies or financial products.

Bradford Financial Center's financial advisory team is built on over 50 years of experience, financial planning longevity, and a wide expanse of industry knowledge. We're happy to discuss your goals and needs without any pressure. Learn more about our team of professionals.