In 2019, Bradford Financial Center began celebrating its 50th Anniversary as a company. We kicked off the summer with a super-sized birthday cake float rolling through community parades to promote the 50th Anniversary, which was recognized in July 2020. As we journeyed through this celebration, it's essential to look back on our history, the people, ideas, and moves that brought Bradford Financial Center to this great milestone.

Company Timeline

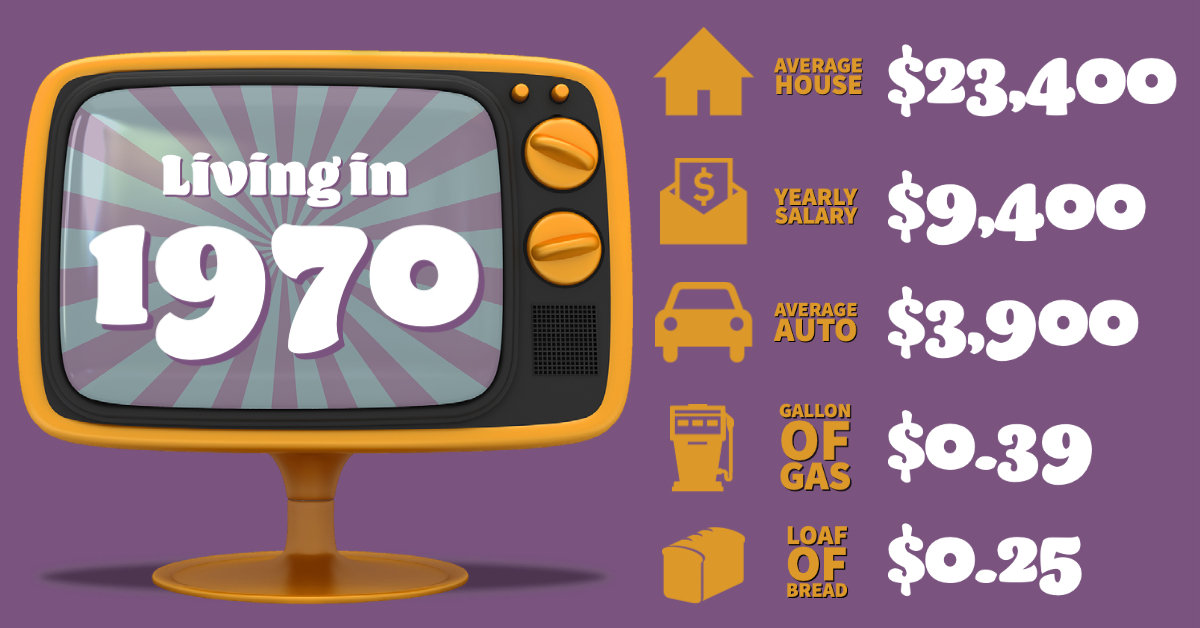

1970

Bradford Beginnings: Founder Jim Tausz opens the one-person office and future company in Eagle Grove, Iowa.

1980

Branding for the Future: The company changes names from Tausz Financial to Bradford Financial Center, receives its own symbolic crest, and paves the way for growth.

1990

Weathering the Stock Market Crash. Pressures from the stock market crash of 1987 inspire Bradford Financial Center to adapt and position the company for growth ahead.

2000

Persevering in Troublesome Markets: Over the course of 30 years, an investment company sees some of the best times and some of the worst.

2010

A Decade of Growth: Fresh out of the recession, wounded markets and Bradford prepare for growing and evolving as a national financial company.

2024

Headquarters Move: Bradford Financial Center moves into new headquarters location in downtown Clarion, Iowa, solidifying its roots in Clarion while unlocking fresh opportunities for growth and expansion.

1970

On July 1, 1970, Jim Tausz started a one-person office in Eagle Grove, Iowa. The beginnings were humble as Jim worked in a 10 x 10-foot room. But it was spacious enough, he recalls...considering he had no clients.

Just one year later, the pace of business shifted enough that Jim moved the company to a rented space in Clarion, Iowa.

In 1975, the company was stable enough to move out of the rental and purchased the first building for the growing financial planning firm.

Why Clarion is Our Cornerstone

Owner Tausz said that over the 50 years of Bradford’s history, they’ve worked with clients across the nation. Having a national reach but Midwest presence always stirs up questions about “why Iowa?” and “why a town with a population of 2,700?”

The answer to that question has more to do with values and family than it does with longitude and latitude.

When Tausz graduated from college in South Dakota, he began his teaching career in Eagle Grove, Iowa.

“My wife and I lived in a trailer in nearby, Goldfield, Iowa. While I was teaching literature and grammar courses, I always knew I wanted to be in the financial industry,” said Jim, who made the switch and earned his master’s degree. “I had to start my new career in a place where people didn’t know me as ‘Jim Tausz, the teacher.’”

In those years, Jim traveled to Clarion, just nine miles from his trailer, to get his hair cut by Jerry Wolf… the only person he knew in the town. The location made perfect sense, but it also aligned with how he and his wife wanted to raise their children: in a small town with Midwest values.

Humble starts have grown Bradford Financial Center into a company threaded with small-town values and good people.

1980

Like rewinding a cassette tape, replaying this turning point in Bradford’s history is sweet music. We’re looking back at a pivotal decade for the company’s growth, the ’80s.

When founder and President, Jim Tausz’s newfound career in the financial advising industry took off, he realized the business name, Tausz Financial, needed to say more. It needed to be encompassing of the teams that were serving clients and the community.

Let’s be honest, brand naming is tricky, and a company name change for Jim was a careful decision.

“The company brand evolution needed to stand the test of time, reflect who we are in tone and personality. But it needed to come from the heart of those who understood it…our people,” Jim recalls.

As a history buff, Jim felt a strong connection to noble characters like King Arthur, but he held an employee brainstorming session for top names.

“We narrowed the ideas down to a few top names, then held a secret ballot. I had a contest for the employees awarding each $100 if they had chosen the top-voted name. Bradford won and it won by a lot,” said Jim.

In medieval history, the Bradford family in England were the royal guard for the king and queen and were known for their strength and loyalty. Like those family names of that time, Jim and his employees created an American

Bradford crest to symbolize the newly named company.

“There is a story behind the symbols and colors. It reflects hope and loyalty, strength, protection and love of country,” Jim explained.

Alas, we now present the coat of arms for all to see. Positioned uppermost and displaying justice and honor is the mighty Excalibur. The helmet denotes wisdom, security, and strength; adorned by a wreath demonstrating eternal and affectionate remembrance. The majestic crown indicates a position of being the defender and protector.

Thou art a comparison to the royal Bradford, a mighty fortress protecting the wealth of the kingdom. The bull representing generosity, and the bear signifying strength, are the supporters of the shield. For be ye assured the shield is like the Bradford’s heart, holding inside the love of country, fierceness and valor, and thou professional wisdom in money management.

Peak Growth

Despite the missing technology of today, the ’80s gave way to significant growth for Bradford. Chief Operations Officer, Darla Tweeten recalls the expansion of the business that led to an increased need for advertising and hiring.

“We were purchasing electric typewriters, real estate, network cabling, and rearranging workspaces to accommodate new hires,” Tweeten says of the fast growth. “It was a time of typewriter white-out and phone call communications; it’s how business was done.”

For Margaret Worden news of Bradford’s growth was no secret and her father encouraged the 20-year-old to “get in there and apply” when he heard they were hiring.

“He was working for Wright County Secondary Roads and Bradford handled their health insurance. I interviewed with Darla Tweeten for the claims administrator position and got the job. To get a claim filed was a lengthy process back then: Open the mailed claim, log it, file it, process and print checks, and then send. Everything was a paper-based process.”

Bradford topped 80 employees and owned a mainframe server system that filled an entire room and people came in just to see this new technology. Today Bradford’s server is the size of a small box.

Growing as a Leader

As Darla Tweeten was creating departments and training up employees, the company was focusing on clients and building a strong reputation in the community.

The ’80s were a time of adapting and embracing regulation changes and technology. Clarion was a bustling community, but most residents had no idea what this busy company called Bradford even did in those offices.

Margaret says it was then that Bradford began to do more marketing to create brand awareness that spread their reach nationally.

Those changes allowed Worden to grow as the Corporate Secretary. The experience encouraged her to get involved in the community and she serves on the Dows City Council and on the Wright County Economic Development Board.

“I would have never dreamt 32 years ago that this one company would have such an impact on my life and that the encouragement of my father would have pointed me to a life-changing job. He would be proud to see how this all turned out and that Bradford’s reputation for managing wealth is still as strong.”

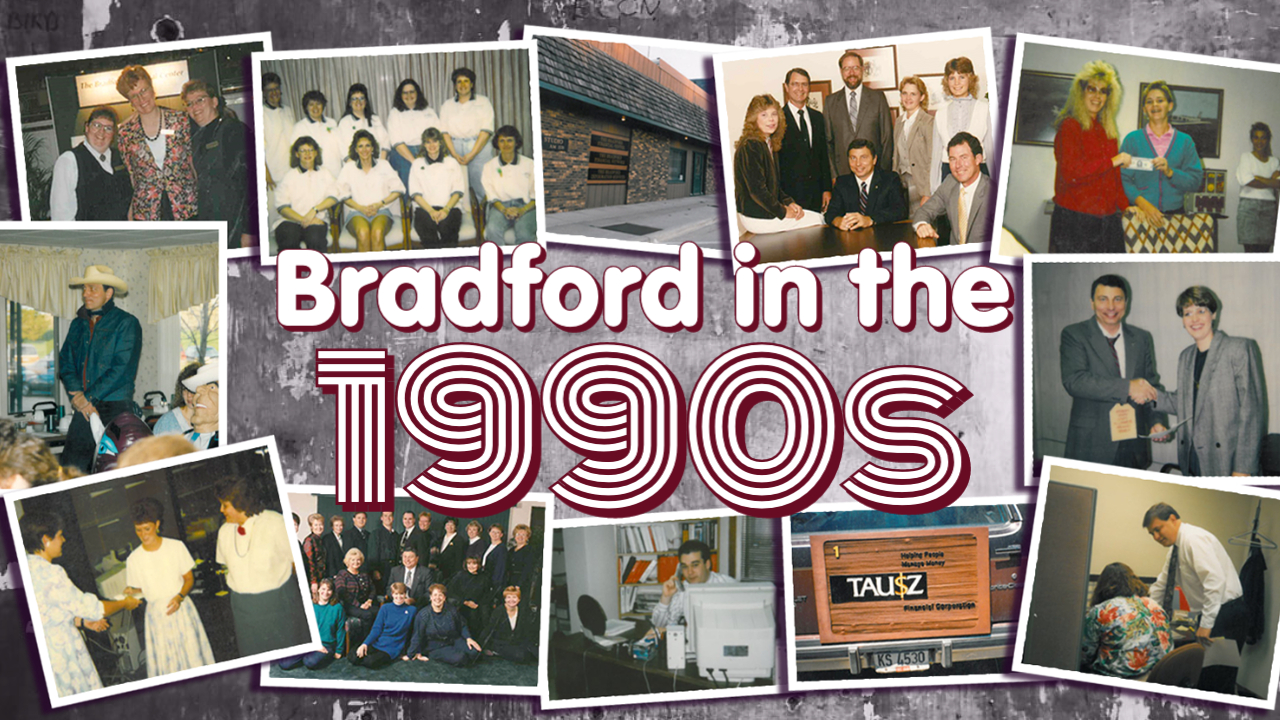

1990

A recession kicked off the decade thanks to the stock market crash of 1987. But like any market shift, it inspired Bradford to retool and refocus products and services that positioned the company for where it is today.

Deb Parker started at Bradford in 1993. At the time she was hired to file claims for cafeteria plans and the office was teaming with 80 employees. It was a time of paper filing and more face-to-face interactions. Faxing was the fastest method of sending documents and businesses were heavily reliant on postal mail. But the 1990s marked a monumental change ahead…the world was just on the brink of awakening to Internet capabilities.

“I just recall how big we were; you really didn’t know others in different departments. It was a very busy time, and the office was bustling with people,” said Parker who is now Bradford’s Marketing Coordinator.

Marty Schimp joined Bradford in 1994 as an independent financial advisor after leaving a large insurance company with limited products and services.

“When I started, the physical office was quite impressive and housed numerous highly trained employees. Throughout the past couple of decades, the staff has certainly changed, but the skill of those positions has not,” Schimp said. “The manner in which these individuals treat our clients with respect and utter friendship continues to amaze me.”

The new job allowed Schimp to contract with additional companies thus offering his clients better solutions to their financial needs and overall, the markets of the '90s presented an opportunity.

“The decade began with a Dow reading of roughly 2600. Throughout the next 10 years, that index had risen to a value of nearly 11,500. Many who were able to invest during that decade created substantial portfolio values,” said Schimp.

Like so many financial companies hard hit in the early part of the era, Bradford began to shift the focus solely on financial planning, removing some of the services Parker was working in, like employer cafeteria plans and medical processing.

“I was fortunate to be able to grow with the company as we took some new risks and forged ahead thanks to Jim Tausz’s vision. He is the heart of Bradford, but truly Bradford is in his heart,” said Parker, also a real estate broker. She was instrumental in brokering the real estate and renovating the Bradford’s Garner location allowing them to expand into tax and accounting services.

Once the markets settled, Bradford was poised for growth. With a vision for steadying the market swings, Bradford President Jim Tausz worked to create a program to protect more of his client’s investments. From the ’90s, the Watch and Manage™ program was born and it changed the impact market downturns eventually had on Bradford client portfolios.

Investment News…On Air

On August 19, 1996, Bradford started the very first radio broadcast.

In an effort to round out their programming, KQWC approached Bradford Financial Center to contribute insights to a financial radio program. Since then, the company has broadcast a live, 60-minute program weekly from 9 to 10 a.m. about market trends, industry, and commodity news and discussed advice on managing wealth.

The show was initially called “American Senior,” but was later changed to, “The Bradford News and Investment Hour,” which better reflected the show’s content.

President Jim Tausz recalls some of the reactions to the airing of the radio programs.

“We get a lot of feedback, especially from clients. When we are in the grocery store or just walking down the streets of Clarion, we have had several people tell us they listen to and enjoy the program.”

For Bradford, it’s always been an important mark of who we are as a company, and the radio show broadcast is our way to help educate the listening public on investing. For that hour-long broadcast we touch on some of the hottest trends both nationally and globally that can impact our clients’ investments.

Tune into The Bradford Financial News and Investment Hour live each Wednesday from 9-10 a.m. on 95.7 FM or 1570 AM. Catch the rebroadcast each Sunday from 1-2 p.m. on 95.7 FM or 1570 AM, and rebroadcast on 92.9 FM on Mondays 3-4 p.m.

You’ll find the latest three broadcasts on our Media Page.

2000

Considering the 80’s Farm Crisis, the 90's Tech Boom, the Recession of early 2000, market turbulence for a financial company can create fear or can force you to adapt. Owner and president of Bradford, Jim Tausz, made the decision to adapt.

“Every decade has delivered major swings. In the world of stocks and securities, volatility is one thing you can count on,” Jim says. “The market will always cycle, and you have to live with that, but what I found scariest was my own personal market.”

The Lean Years

In the early days of his career which Jim calls, “the hungry years,” he admits there were some scary moments for his business.

“My wife was a teacher and I had no clients…zero. Anything I did make helped cover the bills and there wasn’t squat leftover. Suddenly you don’t know what’s around the corner, there’s no cushion,” he recalls.

As a star athlete winning was in his blood, but that time of not excelling in business was daunting. The lean years taught him valuable lessons and he credits that experience for keeping him hungry, striving for more, and working harder.

So, Bradford adapted and developed the Watch and Manage™ program to take advantage of the rise in the market. As a company, we adapted by developing that proprietary software that just Bradford owns.

Adaptation is the name of the game, but staying hungry is a critical element.

“I’m not done yet; I love to make things happen for our employees and our clients. That’s the hunger it takes to keep growing through the highs and the lows.”

2010

The recession of 2007 and 2008 left a bitter taste for many investors, and for Bradford, seeing industries and markets crumble was deeply troubling. But 2010 marked the slope of recovery and anticipation for the opportunities ahead. President, Jim Tausz saw this as a chance to diversity the company portfolio and extend greater growth opportunities to local businesses.

By purchasing real estate in Clarion, Tausz was able to create shared workspaces for other small businesses to set up shop and make a living. Over the decade this footprint expanded and included a consignment shop that would later be called, BZ Neez.

"We don't always consider how important this part of investing can be, but diversifying allows us to balance growth in other areas when the markets aren't delivering," Tausz said. "In turn, the ability to consign items you own rather than tossing them out is a smaller, but still impactful part of keeping more of the money you have."

Helping the community grow has always been at the heart of Bradford who in this decade becomes more deeply involved in their headquarter community of Clarion, Iowa.

2020

A crisis has a way of pressure-testing all aspects of a company, its people, and its processes. Just six months ago, we were heavily invested in a consistently climbing market with clients 100% in active markets.

Enter the coronavirus.

COVID-19 changed everything…except for our resolve, our money management, our financial knowledge, and our faith.

Bradford’s army the envy of General Patton

I’ve always considered this Bradford team to be enviable. Amid work-from-home initiatives (which Bradford has never, in 50 years of business, ever had to do), our team swiftly put our disaster recovery plan into action and has operated as a powerful army. Though we’re not eyeball to eyeball right now, all our operations are being exercised with efficiency and quality like business as usual. It’s been a phenomenal experience to witness.

The phones are being answered and administered. Darla Tweeten, our office manager is my right hand and has proven our team is equipped for this challenge. Our insurance department is going strong. Clients are dropping off their tax documents and we’re getting those important tax preparations done as a part of Bradford Tax and Accounting. Our trust department is running full blast and our financial planners are talking with clients and making trades. This is the kind of army that even General Patton would be proud to have.

Investor Confidence

The rollercoaster that unfolded over the second and third quarters of 2020 along with the unwieldiness of the markets had many financial institutions dealing with negative calls. Tausz said he was genuinely amazed at how Bradford's clients responded. “Personally, I’ve taken 18 calls from clients since this pandemic began, none are negative,” Tausz said.