How Your 2018 Your Tax Returns Were Impacted by the Government Shutdown and What You Can Expect for 2019 Tax Season

Tax Returns, Tax Reform and How it Affects You

Whenever we talk taxes, the focus is on one specific date: April 15. The prolonged government shutdown at the start of the year and potential impending government shutdown are shifting the focus for tax preparers and filers who can expect some delays. Part of the tax conversation is also centered on what lingering impact the Tax Cut and Jobs Act will have on your returns.

Government Shutdown Impact on Tax Returns

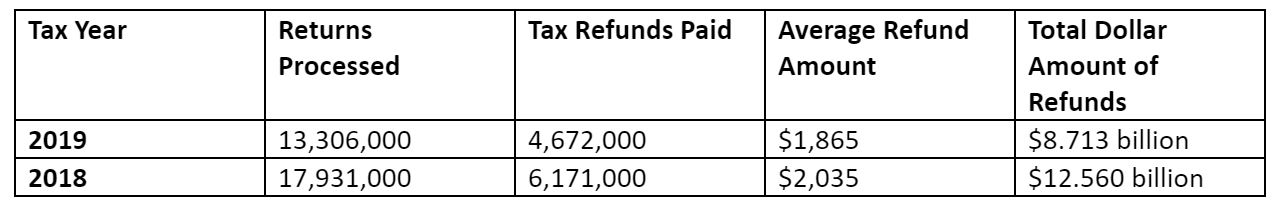

Here’s what taxpayers can expect! When we put into perspective how the output from the IRS has changed, when compared to the same time last year, the numbers look like this:

According to the IRS filing data, the IRS processed returns (first week of filing season) dropped by 25.8% and dollar amounts of tax refunds dropped by 24.3%. The average refund declined from $2,035 to $1,865, an 8.4 percent drop. The total dollar amount of refunds took a steeper tumble, plummeting 30.6% from $12.560 billion to $8.713 billion.

The ability to serve both the tax preparer and taxpayers they serve is increasingly challenging. The National Taxpayer Advocate reports that on the day before the shutdown ended, the IRS had more than 5 million pieces of mail waiting to be "batched," 80,000 responses to audits that needed to be addressed, and 87,000 amended returns that had not been processed.

The National Treasury Employees Union national president Tony Reardon, representing IRS employees, cited the report and warned against another shutdown, “[The] report brings into sharp relief just how difficult it is for an underfunded, understaffed agency to function at a high level when most of its workforce was locked out for a month before the start of the filing season. I don’t know how anyone can read this report and not be alarmed at the massive amount of damage that has been done to the agency’s workforce and the taxpayers they want to serve.”

Tax Code Changes: Does it Affect You?

The Tax Cuts and Jobs Act of 2017 made significant changes to the tax code. Two major changes that could impact your taxes are the tax bracket thresholds and the increase in the standard deduction. Bradford’s Tax and Accounting team can help put these changes into perspective for your personal returns and you should always consult your tax preparer about preparing, filing and even planning for the tax year ahead.

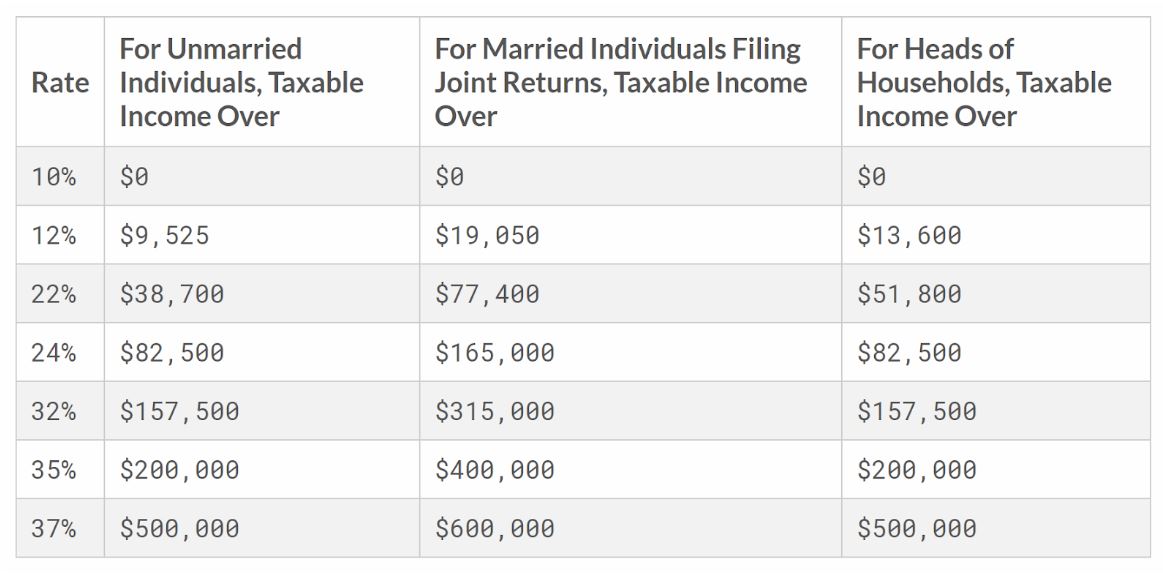

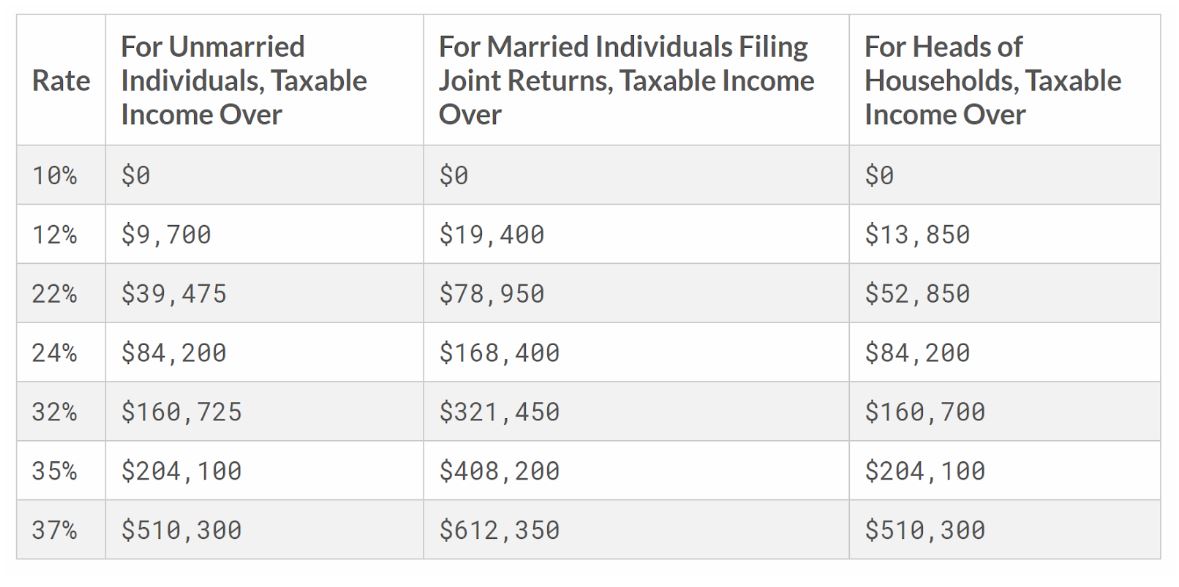

Tax Bracket Thresholds

Marginal tax rates are the percentages of your income that you pay in taxes. With the change in income tax brackets and marginal tax rates, you can see where you fall.

2018 Tax Bracket

2019 Tax Bracket

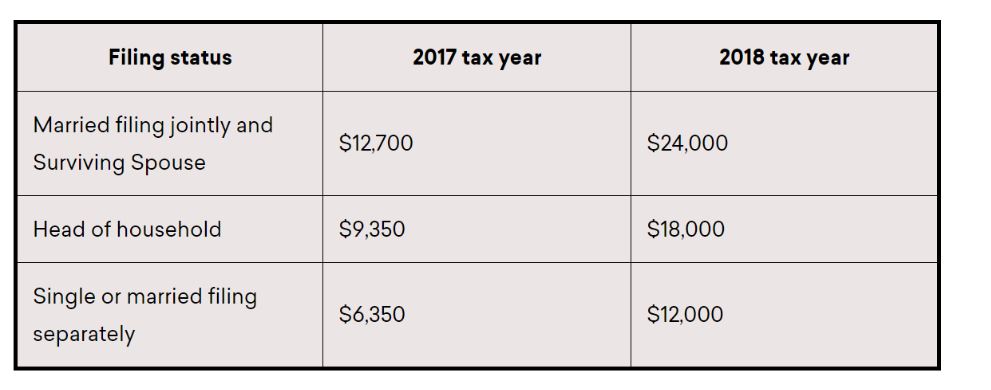

Doubling the Standard Deduction

The standard deduction (an automatic reduction in what you owe in taxes nearly doubled for the 2018 tax year and it’s scheduled to increase with inflation every year through the 2025 tax year.

Consider this comparison of the standard deduction from 2017 to this year:

You can’t take the standard deduction if you itemize your deductions. The 2018 tax reform bill removed the personal exemption (this is the amount a taxpayer was to be able to deduct from their taxable income for themselves and any dependents claimed on their tax return).

But if your itemized deductions are above your standard deduction amount, you could reduce your taxable income even more.

Bradford Tax and Accounting Team

We’re experts at reducing your tax filing stress! When you need help with your personal or business tax preparations, Bradford Tax & Accounting Network delivers trusted experience in value-added tax preparation.

Our goal is to reduce your tax liability through a variety of tools, programs, and credits that are compliant with the latest tax regulations and rules.

Accounting Solutions

Bradford’s team specializes in accounting solutions for individuals and businesses. We customize our services and solutions to match our clients’ needs.

Individual Services

Accounting services are meant to provide accuracy and efficiency all while protecting your financial future and your legacy. Contact us to help you plan, prepare, and protect your hard-earned income.

- Tax compliance and planning

- Tax return preparation

- Personal income tax planning

- Estate and gift tax planning

- Trust tax planning

We’re ready to help you plan for the tax season ahead and prepare returns now.

Tax and accounting services through Bradford Tax & Accounting Network. Bradford Tax & Accounting Network is not affiliated with United Planners. Material discussed is meant to provide general information and it is not to be construed as specific investment, tax or legal advice. Neither United Planners nor its financial professionals render legal or tax advice. Please consult with your accountant or tax advisor for specific guidance.